Investing and Education Made Easy: Immediate Turbo’s Comprehensive Guide

Financial literacy and education have become more important than ever. With technological involvement, investing, trading, and other monetary services have grown complexities. That’s why, today, the basic know-how of them has become imperative.

Digital educational platforms like Immediate Turbo, etc., have made things easier for people. Now, learning about investment, trade, and industry is not a complicated task. Like other social platforms, you can easily register on these sites and kick-start your learning journey. To know more, click here…

In this blog post, we’ll learn about the significance of financial literacy and education and see how the respective platform helps us achieve our goals effectively and efficiently.

Why Immediate Turbo?

Immediate Turbo is an intermediary forum that connects users from the companies that offer instructional services in the field of investments. Read further and learn more about what is offered by this medium.

- Sound Assessments – This platform aids its users in connecting with companies that assist learners in defining their requirements, expectations, and objectives, and then customize their learning process accordingly.

- Investment Strategies Development – Before opting for a specific area, it is vital to consider several aspects like one’s current situation, resources, etc. These affiliated firms assist in determining those aspects to match your portfolio.

- Educational Resources – Tied-up companies from this platform also offer additional learning resources, such as e-books, blog posts, videos, and other materials. This assists students in covering important topics and making notes of them.

- Workshops – Several firms organize educational workshops for their learners. This helps them connect and learn from seasoned traders and know more about their journeys and experiences.

- Diversified Portfolio Guidance – These platforms assist you in making a diversified portfolio, which will eventually help in managing risks and maximizing profits in the future.

Immediate Turbo serves as a medium to connect the seekers and givers. It provides options to choose from the platforms tailored to your specific needs.

Do You Know?

If you don’t start saving until 45, you will need to save three times as much as if you start at 25.

Importance of Financial Literacy in Investing

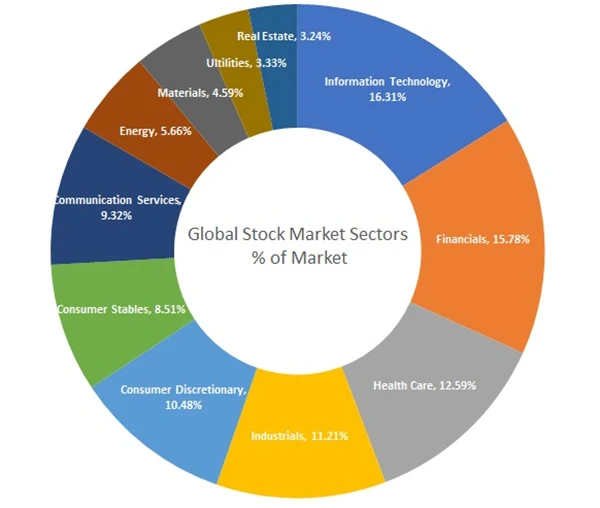

(According to this chart, Information Technology, Financials, Communications, and Healthcare markup over 52% of the world’s companies by value).

Financial literacy is incorporated with several components like budgeting, investing, taxation, borrowing, and personal monetary management. Grasping in-depth know-how about them is important for many reasons:

- Manage Monetary Choices – With accurate economic knowledge, managing expenses, earnings, debts, and overall budget becomes a seamless process.

- Understanding Investment Options – It helps individuals make accurate decisions while opting for an investment option. Whether they buy stocks, bonds, mutual funds, or spend on real estate, having precise knowledge of the market helps to align with goals and risk tolerance.

- Analyzing Market Trends – Financial know-how allows us to interpret economic indicators, related updates, and trends easily. This not only minimizes the risks but also assists in taking advantage of the situation and making the most out of it.

- Safety Against Frauds – Being aware of the industry situation protects you from being scammed. You can conveniently identify common red flags, like investment scams or fraudulent schemes.

- Setting Practical Goals – It helps in setting realistic goals based on an individual’s personal resources, monetary situation, time horizon, and ultimate objectives. It assists in understanding long-term planning, the risks involved, and achieving their milestones.

Financial literacy is imperative for an economically stable and secure life. There are several components of it and so are the benefits.

Follow Us

Latest Post